Introduction

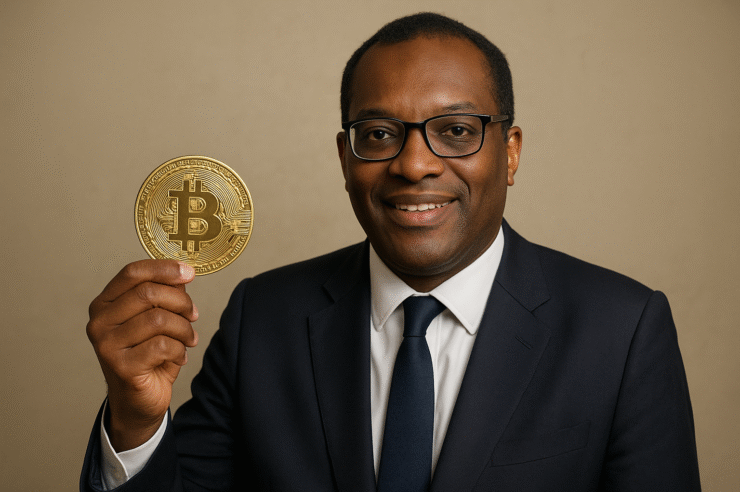

In a significant development for the global cryptocurrency sector, former United Kingdom Chancellor of the Exchequer Kwasi Kwarteng has thrown his support behind a new Bitcoin investment vehicle known as Stack Bitcoin Treasury. The company aims to position itself as a bridge between traditional finance and the digital asset economy, providing corporations and institutional investors with an avenue to gain exposure to Bitcoin as a long-term strategic asset. This endorsement from a former high-ranking British finance minister adds credibility to an industry often criticized for its speculative nature and perceived lack of institutional oversight.

A Former Chancellor Steps Into The Digital Frontier

Kwasi Kwarteng, who served as Chancellor of the Exchequer under Prime Minister Liz Truss in 2022, is one of the most high-profile UK politicians to publicly align himself with the Bitcoin sector. His tenure as chancellor was brief but memorable, marked by an aggressive attempt to introduce tax cuts and stimulate economic growth. Though controversial, his policies demonstrated a willingness to challenge conventional financial thinking — an attitude that appears consistent with his latest venture into digital finance.

By supporting Stack Bitcoin Treasury, Kwarteng is positioning himself at the forefront of financial innovation in the United Kingdom. The firm’s mission is not simply to speculate on Bitcoin’s price but to help major investors and businesses treat Bitcoin as a reserve asset — much like how corporate treasuries hold gold or foreign currencies to hedge against inflation or market volatility.

Stack Bitcoin Treasury — Bridging Traditional Finance And Digital Assets

Stack Bitcoin Treasury, headquartered in London, aims to make Bitcoin accessible to the corporate and institutional world in a regulated and transparent manner. The firm will reportedly allow companies to allocate a portion of their balance sheet into Bitcoin without needing to manage private keys or navigate complex blockchain infrastructure. Instead, Stack will handle custody, compliance, and execution, giving traditional finance professionals confidence in their exposure.

This model is similar to the strategy adopted by U.S. firms like MicroStrategy, which famously converted a significant portion of its corporate treasury into Bitcoin. However, Stack Bitcoin Treasury’s focus appears to be broader — not just investing in Bitcoin for speculative gains, but offering a platform for institutional investors who see the asset as part of a diversified long-term portfolio.

The Institutionalization Of Bitcoin

The timing of this announcement is particularly important. Over the last few years, Bitcoin has moved from being viewed as a fringe investment to a mainstream financial instrument recognized by large institutions. Global asset managers like BlackRock, Fidelity, and Ark Invest have all launched or filed for Bitcoin exchange-traded funds (ETFs). These products enable investors to gain exposure to Bitcoin through regulated markets, reducing the risks associated with direct ownership and custody.

Kwasi Kwarteng’s endorsement adds another layer of institutional legitimacy to this evolving landscape. As a former chancellor, his influence carries weight not only within the United Kingdom but across global financial circles. His backing may encourage policymakers to revisit how the UK approaches cryptocurrency regulation and how digital assets can fit within the broader economic system.

Regulatory Landscape In The United Kingdom

One of the major challenges facing the UK crypto market is regulatory uncertainty. While the Financial Conduct Authority (FCA) has taken steps to establish clearer guidelines for crypto companies, the rules remain complex and sometimes ambiguous. Many firms have struggled to obtain proper licensing, and the FCA’s stance toward retail crypto promotions has been notably strict.

However, the British government has expressed interest in making the UK a global center for digital finance. In 2022, the Treasury announced plans to regulate stablecoins and potentially issue a central bank digital currency (CBDC). Kwarteng’s support for Stack Bitcoin Treasury aligns with this broader national ambition. His involvement could help open doors between regulators, financial institutions, and innovators — fostering dialogue that balances consumer protection with technological progress.

Global Economic Context And The Role Of Bitcoin

The backdrop for this announcement is one of global economic uncertainty. Inflation remains elevated across major economies, and central banks are grappling with the trade-off between curbing inflation and maintaining growth. Against this volatile environment, many investors have begun to question the sustainability of fiat currencies and traditional government bonds.

Bitcoin’s appeal as a hedge against inflation and monetary debasement has therefore gained renewed attention. Its scarcity, algorithmic supply schedule, and independence from political influence make it an attractive alternative asset for long-term holders. Institutional investors, family offices, and sovereign funds are gradually exploring its role as a component of diversified portfolios.

A Political Endorsement With Economic Implications

Political figures rarely engage directly with cryptocurrency ventures, partly because of the reputational risks and regulatory gray areas surrounding the sector. For that reason, Kwarteng’s support for Stack Bitcoin Treasury is both notable and symbolic. It sends a message that digital assets are no longer the exclusive domain of tech enthusiasts or speculative traders, but a serious area of financial innovation worthy of policy discussion.

His involvement could also inspire confidence among institutional investors who remain cautious about entering the crypto space. When former government officials endorse such projects, it signals that digital assets are moving closer to mainstream acceptance. This legitimization may accelerate capital inflows into Bitcoin-related financial products, especially among corporate treasuries and investment funds.

How Stack Bitcoin Treasury Could Shape Corporate Strategy?

For corporations, Bitcoin exposure offers both opportunities and challenges. Companies like Tesla, Block, and MicroStrategy have demonstrated how Bitcoin can serve as a store of value on corporate balance sheets. However, these moves also expose companies to significant price volatility.

Stack Bitcoin Treasury’s value proposition lies in offering a managed solution that balances exposure with professional risk management. Instead of buying Bitcoin directly and dealing with the operational complexities, firms can invest through Stack’s structured products or managed treasury accounts. This approach simplifies compliance, auditing, and valuation — crucial factors for publicly listed entities and institutional investors bound by fiduciary duties.

Long-Term Vision — From Speculation To Strategy

Kwarteng’s involvement is not just about short-term profits; it aligns with a broader narrative about Bitcoin’s role in the future economy. Over time, more corporations may hold Bitcoin as a treasury asset — not merely to speculate but to hedge against currency depreciation and geopolitical risk.

In a world of growing economic interdependence, where trade imbalances and sovereign debt burdens are intensifying, Bitcoin offers an apolitical and borderless alternative to traditional stores of value. The vision shared by Stack Bitcoin Treasury and its backers seems to be that Bitcoin will eventually become an integral part of financial infrastructure — a digital gold underpinning the next generation of global finance.

Market Reactions And Investor Sentiment

The announcement of Stack Bitcoin Treasury’s launch has drawn attention from both the crypto community and mainstream financial press. Analysts view Kwarteng’s endorsement as a sign of increasing crossover between traditional politics and blockchain finance. Although Bitcoin’s price has recently faced downward pressure, this kind of institutional news often provides long-term bullish signals.

Many experts argue that while short-term volatility may persist, the underlying trend points toward growing adoption. Institutional vehicles such as ETFs, custodial services, and treasuries are building the infrastructure needed for Bitcoin to mature into a full-fledged asset class. Stack Bitcoin Treasury’s entry into this field reinforces that trend within the European market.

Potential Challenges Ahead

Despite the enthusiasm, significant challenges remain. Bitcoin’s price volatility, environmental concerns, and uncertain global regulation could hinder widespread adoption. Moreover, as governments explore their own central bank digital currencies, competition between private decentralized assets and state-issued digital money could intensify.

Stack Bitcoin Treasury will need to navigate these complexities while maintaining transparency, security, and compliance. Kwarteng’s political background could be an asset in engaging with regulators, but the firm must also demonstrate that its model is sustainable and aligned with investor protection standards.

Conclusion

Kwasi Kwarteng’s endorsement of Stack Bitcoin Treasury symbolizes a new phase in the institutionalization of Bitcoin within the United Kingdom. It bridges the gap between the old world of centralized finance and the emerging world of decentralized digital value.

As financial systems evolve, the collaboration between policymakers, entrepreneurs, and investors will shape how Bitcoin and other digital assets integrate into the broader economy. For the UK, embracing this innovation could restore its position as a leader in global financial services. For Bitcoin, it represents another milestone on its journey from experimental technology to a mainstream store of value.